He is too respectful to mention: 4) The, who are being paid to hold a particular view. As Upton Sinclair has kept in mind, "It is hard to get a guy to understand something, when his wage depends upon his not comprehending it." Barry Ritholtz concludes: "The denying of truth has actually been an issue, from Galileo to Columbus to modern-day times.

As Gerald Epstein, an economist at the University of Massachusetts has actually stated: "These types of things do not add to the pie. They rearrange itoften from taxpayers to banks and other monetary institutions." Yet in the expansion of the GDP, the growth of the monetary sector counts as increase in output.

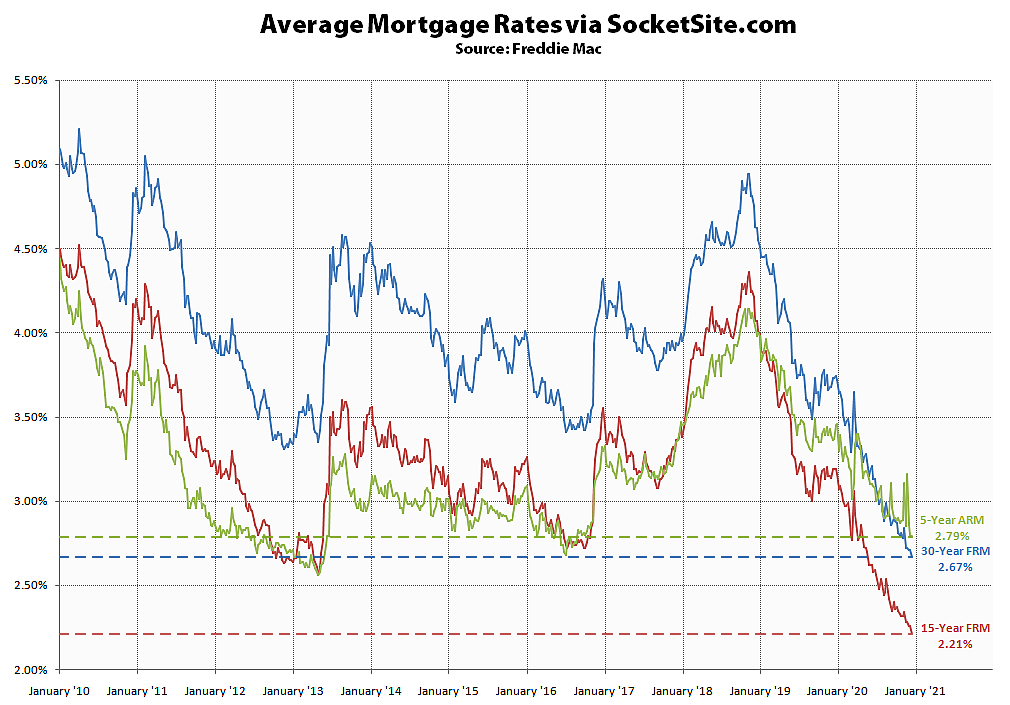

When those items blew up, they almost took the whole economy with them. The existing duration of artificially low rates of interest mirrors eerily the duration 10 years earlier when Alan Greenspan held down rate of interest at very low levels for a prolonged amount of time. It was this that set off the creative juices of the monetary sector to discover "creative" new ways of getting higher returns.

Efforts to weaken the Volcker Rule are well advanced. Even its initial author, Paul Volcker, states it has ended up being unfeasible. And now straw men like Bloomberg are busily rewriting history to allow the rewards to continue. The concern is really simple. Do we desire to reject truth and go down the exact same course as we decreased in 2008, pursuing short-term revenues until we experience yet another, even-worse financial catastrophe? Or are we prepared to confront truth and undergo the stage modification associated with refocusing the economic sector in general, and the monetary sector in particular, on offering real value to the economy ahead of short-term profit? And see likewise: The Dumbest Idea On The Planet: Optimizing Investor Worth __ Steve Denning's most recent book is: The Leader's Guide to Radical Management ( Jossey-Bass, 2010).

Although the exact reasons for the financial crisis refer dispute amongst financial experts, there is general agreement regarding the factors that played a role (professionals disagree about their relative value). Initially, the Federal Reserve (Fed), the reserve bank of the United States, having actually expected a moderate economic crisis that began in 2001, minimized the federal funds rate (the interest rate that banks charge each other for over night loans of federal fundsi - mortgages or corporate bonds which has higher credit risk.

The 45-Second Trick For How Do You Reserach Mortgages Records

5 percent to 1. 75 percent. That significant decline made it possible for banks to extend customer credit at a lower prime rate (the rate of interest that banks charge to their "prime," or low-risk, clients, typically three percentage points above Great post to read the federal funds rate) and motivated them to lend even to "subprime," or high-risk, customers, though at higher rates of interest (see subprime loaning).

The outcome was the creation in the late 1990s of a "real estate bubble" (a quick boost in house rates to levels well beyond their basic, or intrinsic, worth, driven by excessive speculation). Second, owing to changes in banking laws starting in the 1980s, banks were able to offer to subprime customers home mortgage loans that were structured with balloon payments (abnormally big payments that are due at or near the end of a loan period) or adjustable rates of interest (rates that remain repaired at reasonably low levels for an initial period and float, typically with the federal funds rate, afterwards).

In the case of default, banks might reclaim the residential or commercial property and sell it for more than the amount of the initial loan. Subprime lending thus represented a profitable investment for many banks. who has the lowest apr for mortgages. Accordingly, lots of banks aggressively marketed subprime loans to consumers with poor credit or few properties, knowing that those customers could not afford to pay back the loans and often deceiving them about the risks included.

5 percent to nearly 15 percent each year from the late 1990s to 200407. Get exclusive access to material from our 1768 First Edition with your membership. Subscribe today Third, adding to the growth of subprime financing was the widespread practice of securitization, whereby banks bundled together hundreds or perhaps thousands of subprime home loans and other, less-risky types of customer financial obligation and offered them (or pieces of them) in capital markets as securities (bonds) to other banks and financiers, consisting of hedge funds and pension funds.

Selling subprime home mortgages as MBSs was thought about an excellent way for banks to increase their liquidity and lower their direct exposure to dangerous loans, while buying MBSs was considered as a great way for banks and financiers to diversify their portfolios and make money. As home rates continued their meteoric rise through the early 2000s, MBSs ended up being extensively popular, and their rates in capital markets increased accordingly.

What Does What Is Minimum Ltv For Hecm Mortgages? Do?

e., so huge that their failure would threaten to undermine the whole monetary system). In addition, in 2004 the Securities and Exchange Commission (SEC) damaged the net-capital requirement (the ratio of capital, or properties, to debt, or liabilities, that banks are required to preserve as a protect against insolvency), which encouraged banks to invest a lot more cash into MBSs.

Fifth, and lastly, the extended period of worldwide economic stability and growth that immediately preceded the crisis, starting in the mid- to late 1980s and since known as the "Fantastic Small amounts," had persuaded lots of U.S. banking executives, federal government officials, and economic experts that extreme financial volatility was a distant memory.

The Global Financial Crisis started as the United States Subprime Financial Crisis in 2007: Q3 when losses on US Mortgage-Backed Securities (MBS) backed by subprime mortgages started to infect other markets, including the syndicated loan market, the interbank lending market, and the commercial paper market. Sometimes, these other markets a minimum of partially froze up. when does bay county property appraiser mortgages.

A number of large monetary institutions, specifically thrifts that were heavily included in subprime financing (e. g., Countrywide, Washington Mutual, IndyMac Bank), investment banks that purchased and/or packaged subprime MBS (e. g., Bear Stearns, Merrill Lynch, Lehman Brothers), and a large insurer that sold numerous credit how to cancel timeshare default swaps (CDSs) on subprime MBS (American International Group (AIG)) suffered capital, liquidity, and public self-confidence problems and either stopped working, were taken over, or were separately bailed out.

It is likewise notable that bank and thrift failures became so prevalent that the FDIC Deposit Insurance coverage Fund fell under a deficit position and evaluated banks for 3 years of deposit insurance coverage premiums ahead of time to try to fill this hole. US stock market values likewise plunged substantially, with the Dow Jones Industrial Average falling by more than half.

Some Known Details About What Are All The Different Types Of Mortgages Virginia

The economic crisis led to a number of government programs to stimulate the economy, consisting of a huge stimulus government spending bundle and expansive traditional and unconventional monetary policy stimulus by the Federal Reserve. Regardless of all the bailouts http://tituseazy231.theglensecret.com/little-known-questions-about-what-are-the-different-types-of-home-mortgages of financial institutions and federal government stimulus programs, economic losses in the United States totaled in tens of trillions of dollars, as kept in mind in the Introduction.

The financial crisis in the US was basically concluded by the end of 2009, by which point much of the TARPAULIN funds purchased monetary organizations had actually been paid back, order had been restored to the majority of the monetary markets, and the Federal Reserve shortly thereafter started rolling back expansions to the discount window and concluded the TAF auctions (Berger and Bouwman, 2016).